Could the near-risk for MSR portfolios come from higher rates?

Summary:

- Servicing portfolios have been the beneficiaries of sharp increases in primary-secondary spreads and mortgage basis spreads, which taken together, have created a meaningful offset to the dramatic decline in rates.

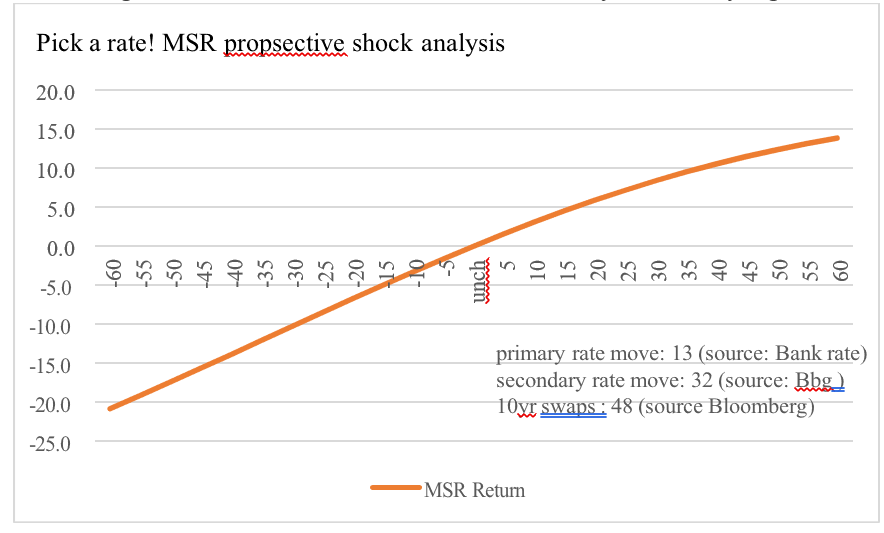

- To provide context, since 8/1 while 10yr swap rates have moved lower 48 bps, 100-strike secondary rates have moved 30 bps, and all-in primary rates by various measures have moved as little as 13!

- Similarly, yet separately, many market participants have indexed their mortgage rate construction to 100-strike related mortgage current coupon driver rates. These securities cannot be purchased nor can they be purchased in enough quantity. Investors are left unable to cover their risk and are helpless as rates rally. Spread widening has helped investors here also.

- The combined move in both primary-secondary spreads and mortgage basis spreads has created meaningful offset that has provided refi-offset to mortgage servicing portfolios. While indexing to 100-strike creates a general lack of transparency and creates additional challenges for risk management and hedging, it has yet to create meaningful mark to market pain because of the most recent spread widening.

- For those that are unhedged or those that are hedged to 100-strike MSR portfolios, there is significant risk to spread tightening from both primary-secondary and mortgage basis spread offset with higher rates.

- While intuitively good for MSR portfolios, a move higher in rates could pose an attribution challenge for MSR valuations because of initial spread tightening – either through basis tightening and/or primary-secondary tightening.

- Have questions about our model? We’re glad you asked. BWFT’s model is indexed to 102 strike current coupon and has built in primary-secondary offsets into its model, which for the reasons mentioned above, meaningfully reduce the impact(s) of these challenges.

Modeling Implications – Primary, Secondary, or Swaps? Which is most Appropriate?

Whether your valuation provider uses mean reversion (a modeling trick where mortgage rates converge to either swaps or secondary mortgage rates), or your valuation provider is benchmarked off a 102- or 100-strike current coupon and/or your valuation provider assumes underlying behavior for primary-secondary spread tightening, MSR portfolio valuations currently vary substantially. For BWFT’s part valuing the MSR off its singular drive rate, primary rate, is the method of choice given the firm’s core belief that MSR is a function of refi-incentive. Put simply, individual borrowers are closest to the ‘primary rate’ and modeling the prospective primary rate – though not as convenient a proxy (as 100 coupon). From a BWFT perspective mortgage refinancing behavior is therefore almost exclusively a function of loan characteristics, spread at origination, credit characteristics and ambient mortgage rates. Through this market rally it is easy to see that, had one modeled using a collection of just swap or mortgages rates they would likely have significantly over hedged or under hedged their portfolio.

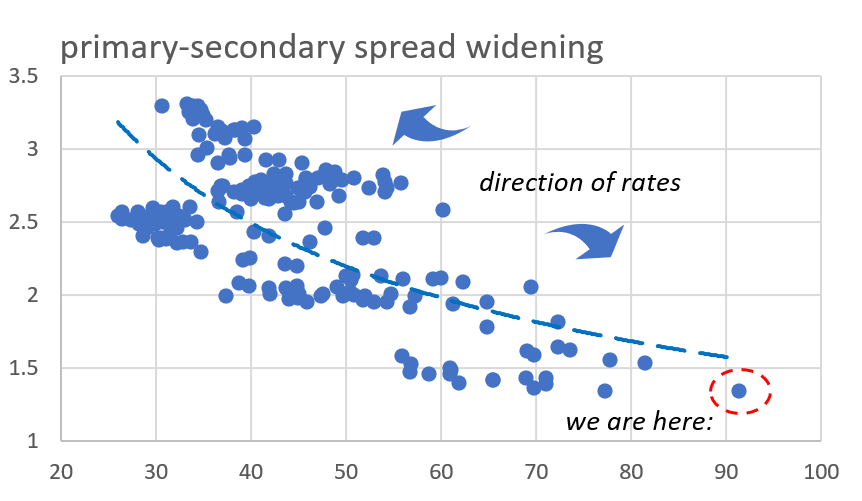

Figure 1: Primary-Secondary spreads have been directional with swap rates

(NOT) Great expectations: Could potential primary-secondary spreads tightening create additional risk?

Primary-secondary spreads have widened as rates have rallied. Take a look at the above scatter plot (Figure 1). The move wider in Primary-Secondary spreads has been good for originator margins. Primary-secondary widening has also caused MSR portfolios to outperform versus their existing rate shocks (see Figure 6 below). Prepayment speeds have come in *generally* better than expected across the board. Could higher rates cause primary – secondary spreads start to drift inwards? Since there is no liquid proxy for primary rates, tighter primary-secondary spreads could cause un-hedgeable mark-to-market losses for owners of mortgage servicing – even with the overall rates market stabilizing or inching higher.

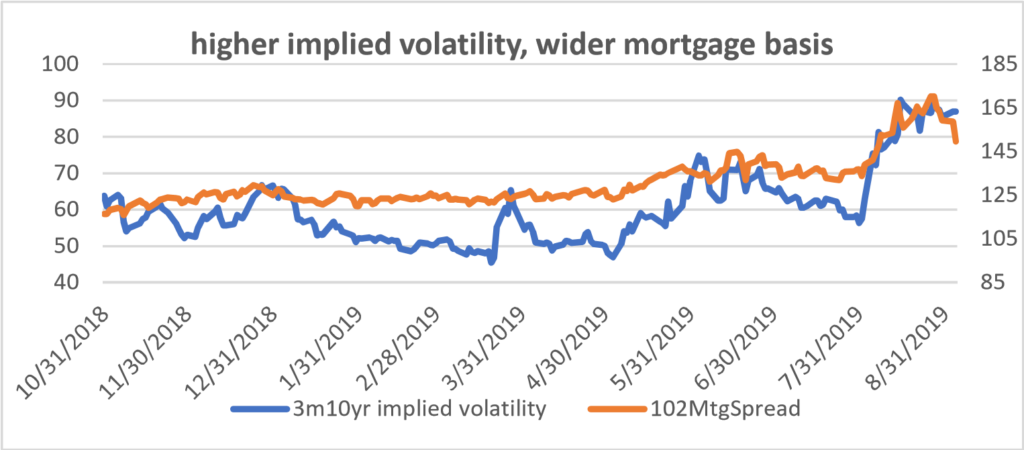

The mortgage basis has moved wider with higher implied volatility – providing another valuable offset to MSR

Recently the mortgage basis has widened. Implied volatility has also risen. Both mortgage spreads and implied volatility measures have risen together (please see Figure 3). This has been a boon to mortgage servicing portfolios. Why? Most of the non-bank originators value using current coupon models indexed to par (100-strike MSR valuation models). Through yesterday, indexing off a 100-strike MSR composition would imply that an owner of MSR tied to a 100-strike valuation would be indexed to securities that are just not available (notably UMB 2.0’s and UMB 2.5’s). While indexing to 100-strike creates a general lack of transparency and creates additional challenges for risk management and hedging, it has yet to create meaningful mark to market pain. This can be explained almost entirely by the recent spread widening in both primary-secondary and mortgage basis spreads. To provide context, since 8/1 while 10yr rates have moved lower 48 bps, 100-strike secondary rates have moved 30 bps, and primary rates by various measures have moved as little as 13! Due to the material widening in spreads, MSR portfolios have rally-adjusted performed rather well. Yet there could be potential risk to rates moving higher and/or volatility dropping and a meaningful spread compression for this same set of MSR portfolios. Generally falling implied volatility has been a reason for mortgage basis spreads to tighten (see Figure 3 and Figure 4).

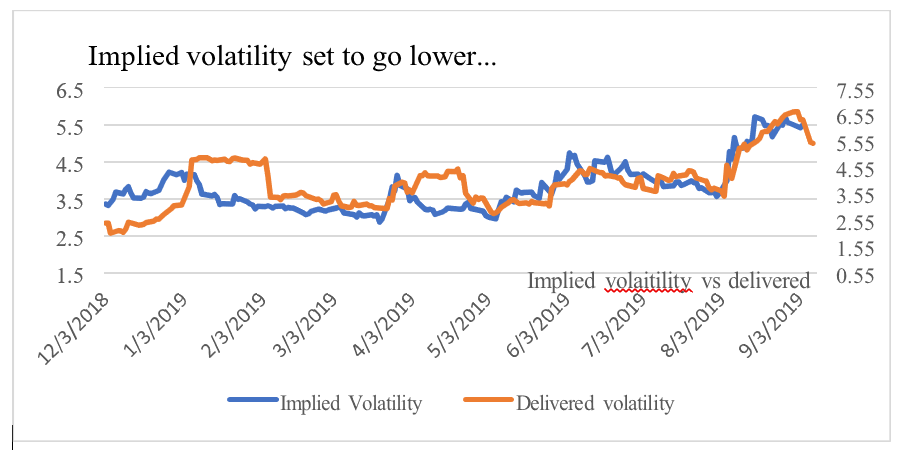

Figure 2: Implied volatility tracks delivered volatility, and delivered volatility is going lower

Figure 3: Higher implied volatility recently portends to higher / wider mortgage basis

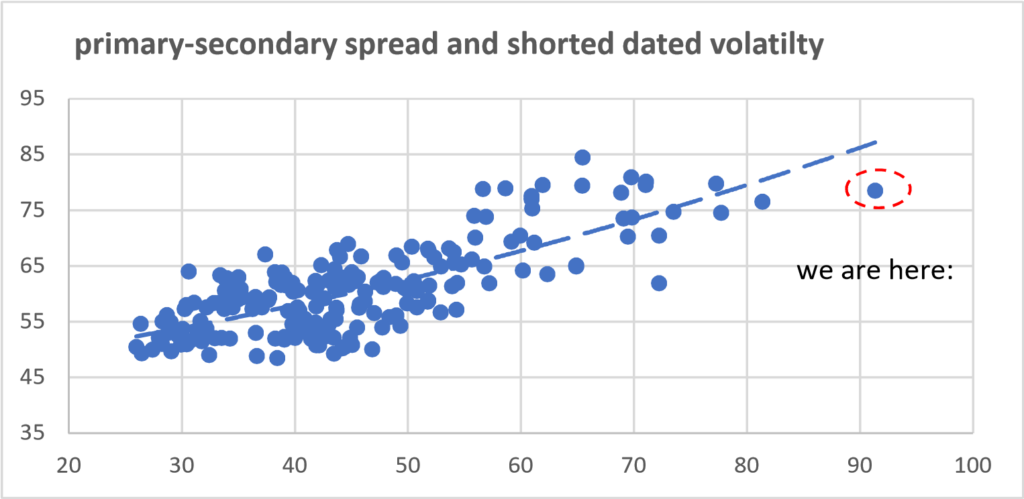

Figure 4: Primary Secondary spreads has implied volatility in a lock step fashion

Notwithstanding the above relationships, with the move higher in rates, both primary-secondary spreads and mortgage basis spreads have also widened with implied volatility (see Figure 3). If rates were to suddenly stabilize or rise, implied volatility could also decline. Here-in lies the compelling part of our concern. Implied and delivered tend to track one another as implied volatility is viewed as historical volatility plus a risk premium. Figure 2 depicts the relationship between implied (1m into 10yr) and delivered volatility (similar historical window). Recently delivered volatility has started to drop. This would imply that in concert, implied volatility should also drop. While the link between primary-secondary to implied volatility is controversial (is it causal or merely correlational?) the correlative link does appear to exist and therefore the possibility of both primary-secondary and basis spread tightening with a stabilizing market is potentially material.

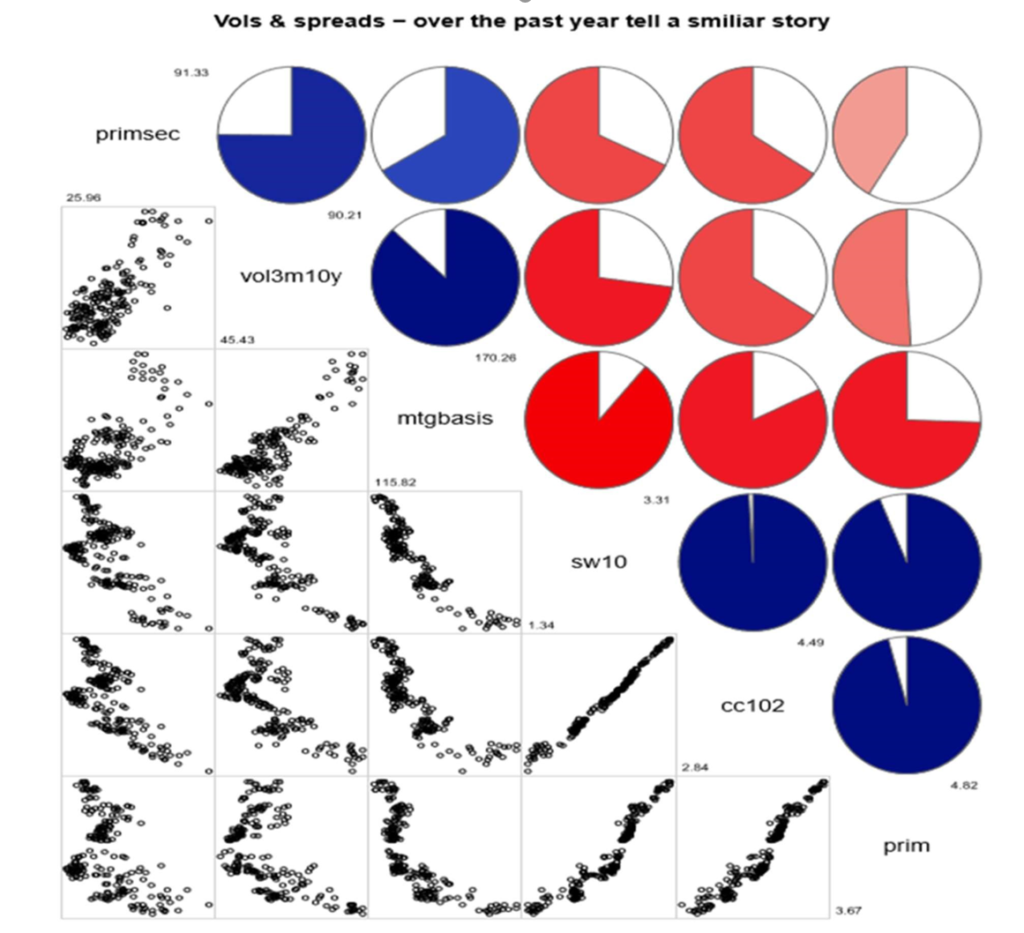

Figure 5: Vol, mortgage basis and primary-secondary spreads – scatter, correlation and ranges

Avid readers will notice that the shaded area in the above correlogram (Figure 5 above). Each of the various components of the rates complex primary-secondary spreads, implied volatility, mortgage basis, 10yr swap rates, current coupon rate, and primary rates are listed above in the diagonals of the above chart. For reference in each square, we list the range of each variable. The top panel represents color-coded pie charts that depicts the sign and magnitude of correlations. The pairwise scatter plot forms each panel on the lower left. The shaded area above highlights the positive correlation that primary-secondary spreads, mortgage basis, and finally implied volatility share between them.

Summary & Discussion:

MSR portfolios have performed well considering the decline in mortgage rates. This is particularly true if one uses a primary rate driven model. Since primary rates are difficult to observe some degree of financial engineering is required in order to construct an appropriate and internally consistent valuation. The choice and mix of model parameters have a meaningful dynamic on the ultimate behavior and eventual valuation of MSR of the life of the asset.

Throughout this paper BWFT has documented and analyzed the meaningful ‘buffeting effect’ noticeable in most of its Client-driven MSR portfolios. The subject of this paper has been to carefully understand various facets of mortgage basis, implied and delivered volatility, level of rates and primary-secondary spreads and their associated interaction. With rate stabilization and with implied volatility potentially dropping, mortgage spreads whether they are primary-secondary or mortgage basis spreads could meaningfully offset a rise or stabilization in mortgage rates. While intuitively good for MSR portfolios, a move higher in rates could pose an attribution challenge for MSR valuations because of initial spread tightening – either through basis tightening and/or primary-secondary tightening. Stay tuned.

Rating the Performance of various MSR measures – valuation uncertainty

Figure 6: Pick a rate! MSR valuation uncertainty is currently high

Servicing portfolios have been the beneficiaries of sharp increases in primary-secondary spreads and mortgage swap spreads, which taken together, result in a muted overall sensitivity to rates. This could change – particularly if rates stabilize and/or rates rise. There is reason to believe— just based off of the sharp variation in rates swaps, secondary and/or primary rates—that different MSR models will behave differently. It is entirely possible therefore that by using different model driver rates, applied to the same shock, MSR values can vary substantially.

Contact Information

Alan Qureshi

Managing Partner

aqureshi@bluewater-fintech.com

Travis LaMar

Managing Director, Capital Markets

tlamar@bluewater-fintech.com